Summary

- Retirement investing today is very different than it was 3 months ago.

- Traditional bonds and stocks simply aren’t enough anymore.

- We look at lesser-known asset classes that we use to generate 4-6% yield in today’s yiedless world.

Facing current circumstances

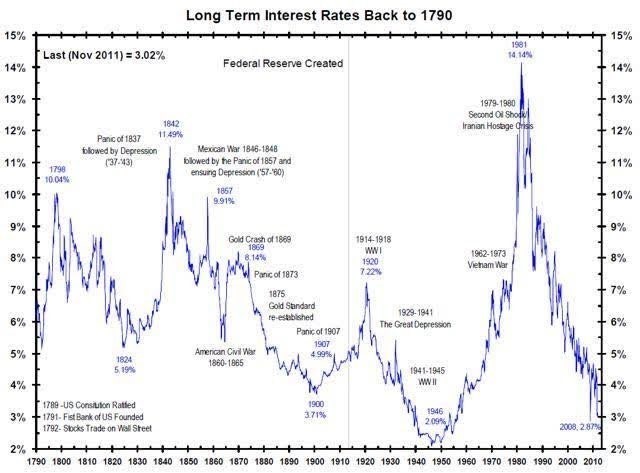

The idea of retirement in 2020 looks much different than it has in the past. Today more than ever, it’s extremely important that investors focus more on their investments than in any time in recent history. In past decades, those planning for retirement had a sizable investment in fixed income instruments, reason being that government bonds, which are viewed as the safest investments, were paying upward of 8% yields. However, in today’s zero yield world, retirement investing is entirely different from the past.

With rates sitting at these historically low levels, retirees must look elsewhere to earn their much-needed retirement income.

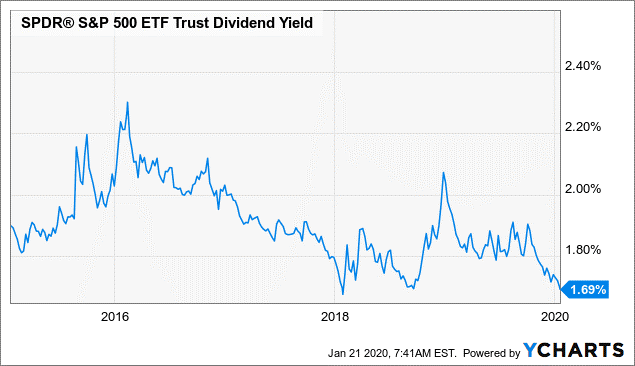

Stocks (SPY)? Nope. The yields are not any better:

Data by YCharts

Because traditional bonds and stocks do not produce enough income to satisfy the needs of retirees, we must look elsewhere. More specifically, we must look for less crowded sectors that are overlooked and out of investor’s attention.

We look at investing in subordinated bonds and asset backed loans.

Subordinated Bonds For Reliable Income

Another solid investment for retirees in this low interest rate environment are subordinated bonds. Subordinated bonds are bond investments that have special rules that distinguish them from senior bonds. Most importantly, they are issued by major institutions and have better liquidity and credit ratings compared with corporate bonds.

Whilst they don’t have the same priority as senior bonds they have similar liquidity but better. Yield options, therefore they tend to be less volatile than corporate bonds and high yield opportunities.

How do we find subordinated bonds?

Like most bonds it’s essential to focus on companies with strong balance sheets with cash flows to sustain repayments. Concentrate on credit rating and avoid sector risks which impact the ability of the issuer to finance repayment.

Whilst subordinated bonds have not been immune from the contagion risks during March in the bond markets. They’re ability to recover following central bank stimulus and better issuance quality has seen a U shaped recovery from the peak of their drawdowns in mid March.

A good example of a fund based investment into subordinated bonds is ASG Dynamic Income Fund which pays between 5-6% yield. The Fund has generated consistent cash flows from a solid portfolio of over 70 underlying positions. The management team invests no more than 3% into any one single position with an average weighting of 1.7%. The Fund has focused on quality financial institutional names thus limiting the risk of spreads compared to corporate or high yield funds. The Fund recently recovered 9.5% from its recent drawdown.

The ASG Dynamic Income Fund is available in UCIT format and has daily dealing.

A Look At Asset Backed Loans

Asset backed loans have been a particularly popular topic over the recent months. With continued scarcity of financing options, alternative finance routes will provide a major backstop to alleviate recessionary pressures for many SMEs.

ABL loans are issued with quite conservative loan-to-value ratios, with the collateral tending to be worth 30 to 40 per cent more than the loan and any interest accrued. In most cases, the collateral is protected in a trust or a special purpose vehicle and personal guarantees also tend to be required. This technique lowers the risk of defaults.

The primary risk of investing in ABL funds is the prospect of fraudulent collateral being put forth and poor fund management, and investors are advised to perform due diligence on funds beforehand and should monitor the strength of their collateral.

Katch Lending Opportunities Fund has a multi strategy lending approach. Lending to a broad diversified lending base and for short durations. The Fund has demonstrated strong consistent performance and maintains a healthy pipeline of transactions offering scalability to build portfolio positions.

Here’s why we like these investments as part of a well diversified income portfolio for retirees:

- Their non-correlation with publicly traded stocks can help us financially and psychologically during periods of high market volatility.

- Their short durations enable us to capitalize on stock market volatility to achieve superior long-term returns.

- The fact that the loans are backed with a first lien on the assets themselves decreases the risk of significant loss of principal.

- The 8%-12% interest rates offered on these loans in the era of sub 2% or less interest rates offered on savings accounts, short-term bonds, and CDs gives them an exceptional potential risk-reward profile as a short-term alternative to publicly traded markets.

- The ability to widely diversify across hundreds of these loans with as little as $10 in each one significantly enhances their liquidity and reduces risks negative total returns.

Advantage of a diversified portfolio

When markets get crazy and sell off by 10%, 20% or more within a few months, it can become increasingly challenging to keep a cool head and stay fully invested through the choppy waters. However, with an allocation to alternative, non-correlated investments such as asset-backed loans, the impact from stock market volatility to the overall value is somewhat mitigated. As a result, retirees are much less likely to panic and hit the sell button at the worst possible time and continue to earn steady income.

For more information on ASG Dynamic Income and Katch Lending Opportunities Fund please contact us.

(The author of this article is Marcus Queree, Partner & Director of FundStream. Any information herein is only expressions and opinions. This document does not constitute an offer, an invitation to offer, or a recommendation to enter into any transaction, nor does it constitute investment advice. The information contained herein is confidential and reproduction of any part of this material is prohibited. If you are in any doubt as to the suitability of an investment you should always consult your financial adviser. FundStream does not receive any form of compensation for circulation of such material.)

FundStream provides independent investment solutions to professional advisors to suit their clients portfolio preferences. Our investor network of professional investors include: pension funds, family offices, fund of funds and wealth managers in Europe, Asia and South Africa.

ADDRESS

Kemp House

160 City Road

London EC1V 2NX

United Kingdom

CONTACTS

INFO LEGAL