Absolute Return funds:

A Modern Approach to Diversification

Higher inflation, exacerbated by geopolitical conflict, rising rates and recession fears have converged to create a challenging time for investors. And for traditional 60% stock/40% bond investors it amounts to a perfect storm.

For the past 20 years or so, bond and equity returns have enjoyed a negative correlation; when one goes up, the other goes down. This relationship has helped traditional 60 / 40 investors to reduce portfolio volatility and risk during times of market uncertainty. During an equity correction, for instance, investors could fall back on the value of their bond portfolio for protection.

Lately though, this combination simply has not worked with both equity and bond markets falling meaningfully in tandem. And with no signs of difficult current market conditions abating, this has fueled fears that we could witness a reappearance of the positive equity / bond correlation last seen in the 1970s and early 1980s.

As a consequence, many investors are recognizing the need to look beyond a traditional 60 / 40 structure in favor of a more modern approach. In particular, the concept of achieving diversification via uncorrelated strategies rather than across asset classes which may or may not gain ground.

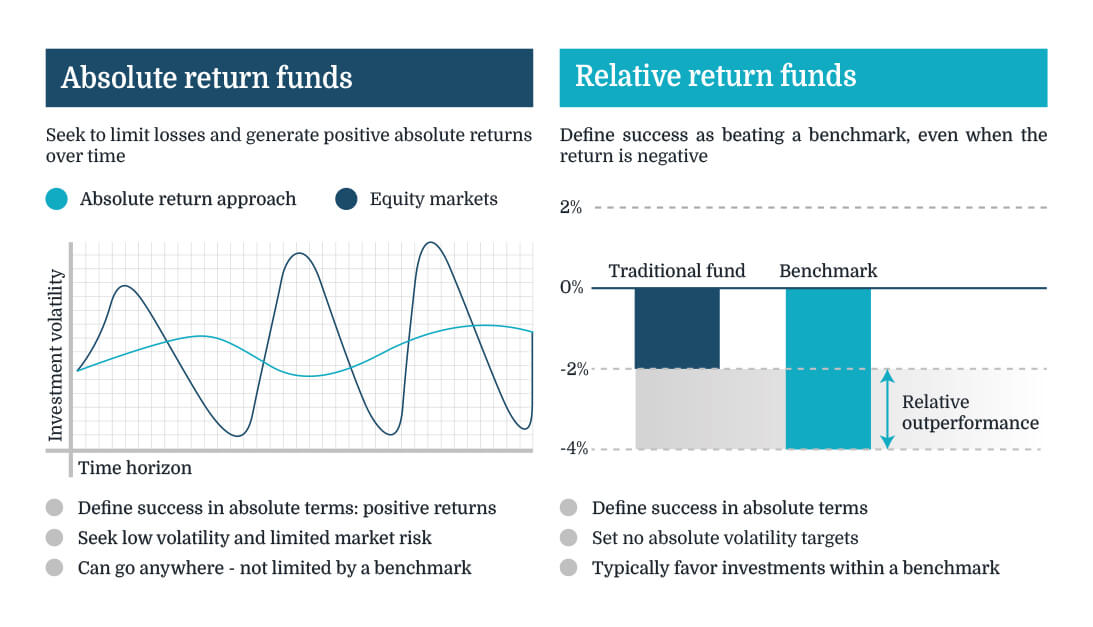

The growing adoption of absolute return strategies is one such example. Absolute return funds typically seek to achieve positive returns in all market environments. Absolute return investing describes a category of investment strategies and mutual funds that seek to earn a positive return over time—regardless of whether markets are going up, down, or sideways—and to do so with less volatility than stocks.

In recent years long-only traditional investors flooded into markets against the backdrop of falling interest rates. This was supported by extraordinarily loose central bank policy in the wake of the financial crisis, damaging normal market volatility, that said, absolute returns should always be embedded into a portfolio strategy, offering true diversified returns.

If you’re like many investors, you may be wondering don’t all funds seek a positive return? The fact is, since the advent of performance benchmarks like the S&P 500 Index, most funds have defined success in relative terms. If a fund outperforms its benchmark, it’s considered a success, even if the fund’s return is negative. If a fund underperforms its benchmark, it’s considered a failure, even if that fund is meeting its stated objective. Relative return funds also rarely set absolute volatility targets, preferring again to compare their volatility against that of their benchmark indexes.

The benefits of being different.

Absolute return funds take a different approach altogether. By doing away with conventional benchmarks and instead striving for consistently positive performance and lower levels of volatility, absolute return funds can offer a number of potential benefits when added to a broadly diversified portfolio:

· Reducing overall portfolio volatility

· Limiting losses in down markets

· Broadening the sources of investment returns

· Providing valuable diversification potential

· Improving a portfolio’s risk-adjusted return

One way to think about absolute return strategies is that they are the worriers of your portfolio. While other portfolio managers are thinking about what can go right in financial markets, absolute return managers are obsessed with what could go wrong and manage risk accordingly.

How do they do it? Absolute return funds vary widely in the tools they use to implement their strategies. In fact, these funds are often referred to as unconstrained because they can invest in a vast array of financial instruments—stocks, bonds, currencies, derivatives, short positions—just about anything that may help deliver that positive return with less volatility.

What absolute return funds have in common is that they generally strive for returns that have a low correlation to traditional stock and bond markets. Correlation is a statistical measure that describes how investments move in relation to each other. If two assets have a correlation of 1.0, they are said to be perfectly correlated and will generally generate returns in the same direction, and to the same degree. If two assets have a correlation of –1.0, they are considered negatively correlated, meaning they perform in the exact opposite direction but to the same degree. A correlation of zero means the two assets have no performance relationship at all.

This lack of correlation can be helpful to a portfolio because there are times during market downturns when correlations rise among traditional asset categories such as stocks and bonds. In fact, 2022 has demonstrated that the time-honored approach of mixing stocks and bonds in portfolio for diversification was simply not enough to prevent losses. Having a portion of a portfolio invested in absolute return strategies is one way of helping to limit losses—and potentially generating gains—when nothing else is going up.

More traditional 60 / 40 portfolios will likely struggle to make positive returns as the global economy continues to recover from the pandemic, monetary policy is tightened and as inflation continues to rise. In this context we believe Absolute Return funds should form part of a permanent allocation of well-diversified, multi-asset portfolios thanks to their ability to generate uncorrelated returns and therefore to improve the overall risk profiles of any portfolio.

(The author of this article is Marcus Queree, Partner & Director of FundStream. Any information herein is only expressions and opinions. This document does not constitute an offer, an invitation to offer, or a recommendation to enter into any transaction, nor does it constitute investment advice. The information contained herein is confidential and reproduction of any part of this material is prohibited. If you are in any doubt as to the suitability of an investment you should always consult your financial adviser. FundStream does not receive any form of compensation for circulation of such material.)

FundStream provides independent investment solutions to professional advisors to suit their clients portfolio preferences. Our investor network of professional investors include: pension funds, family offices, fund of funds and wealth managers in Europe, Asia and South Africa.

ADDRESS

Kemp House

160 City Road

London EC1V 2NX

United Kingdom

CONTACTS

INFO LEGAL