Subordinated or ‘junior’ debt covers all debt ranking below senior debt and above common equity. These bonds are not issued for funding purposes (as is usually the case for senior debt), but for capital purposes. Subordinated debt is a cheaper solution than equity capitalization for issuers.

Many banks and insurers use subordinated debt instruments to meet capital requirements. To illustrate the attractiveness of issuing subordinated debt for issuers, the cost of equity for European financials is estimated to be above 10%, compared to subordinated debt paying coupons of 4% or above in euros. This is indeed a cheaper solution for issuers as well as being a very attractive income opportunity for investors.

From an investor perspective, the key difference between subordinated debt and senior debt arises when an issuer finds itself in a situation of distress. Subordinated bonds rank lower down the capital structure than senior bonds from the same company, therefore, having a lower priority of payment in a liquidation scenario. This said, by only investing in very safe (unlikely to default) companies in the first place, the risk of senior or subordinated debt is effectively very similar. By descending the capital structure of investment grade companies we currently find yields of more than 4% for subordinated debt in EUR and capture an income pick up more than 4 times higher than the senior debt from the same issuer by taking fundamentally the same risk of default.

Who are the issuers and what is the size of the market?

The universe of subordinated financial debt is growing and now has a market cap in excess of USD 1 trillion split between banks (USD 700 billion), insurances (USD 250 billion) and corporates (120 billion), according to our estimates. Historically, the raft of subordinated debt has been issued by financial institutions under the obligation to meet the requirements of the regulatory regimes. Both banks and insurers are obliged to maintain or exceed a minimum amount of capital, respectively 15% of the risk weighted assets for banks (on average) and 100% of solvency for insurers. Capital requirements must mostly be met with equity capital, with an allowance for subordinated debt.

As a result, the whole European banking sector is issuing subordinated debt as well as other financial institutions, such as insurers, with coupons of 4% or above in EUR. Similarly, corporate issuers, particularly those from capital intensive sectors with substantial funding needs, despite not being subject to binding regulations, have also been issuing subordinated debt in the form of corporate hybrids (current market size of circa USD 120 billion). The rationale behind this is not the same as the financial sector; the main reason is because of their favorable tax and rating agency treatment. The combination of low interest rates and attractive issuance costs act as incentives for companies to issue hybrid securities to improve their credit rating profile, lower their funding costs, diversify their financing mix, refinance maturing hybrid issues and finance recent or planned acquisitions.

Why should investors take note?

For investors unwilling to compromise on interest rate risk or credit risk, we think that subordinated debt of strong issuers is an attractive alternative especially within the heavily regulated financial sector where we can find yields of 4% or more in EUR and 5% in USD for securities issued by highly-rated institutions. By moving down the capital structure, it is possible to capture an income akin to high yield without taking on higher default risks.

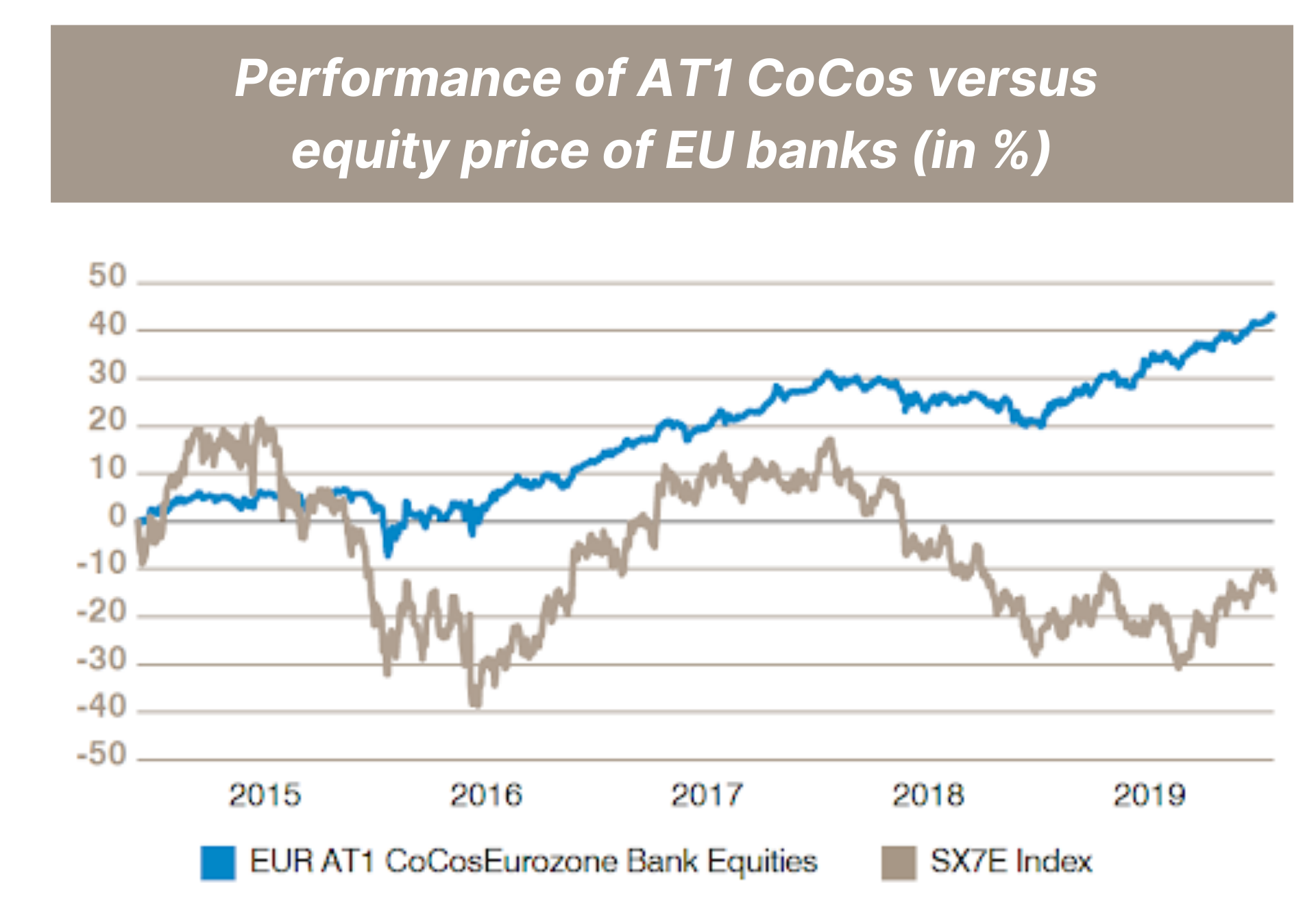

Looking at performances, since 2015, when the European Central Bank started its quantitative easing programmed, the average equity price of the banks in the European Union has declined by 14%, this has been due to the impact of negative interest rates on bank profitability. On the other hand, AT1 CoCos returned 43% in response to overall strengthening fundamentals driven by increasing capital ratio and de-risking in the banking sector. In addition, as the regulatory journey is ongoing, as reflected by Basel IV which will need to be implemented from 2022 up until 2027, we anticipate further capital build up, fundamentally stronger issuers, and potential for high steady income from the subordinated asset class.

Where is the downside?

The importance of choosing the right issuers

If a company has both subordinated debt and senior debt, in the event of bankruptcy or liquidation, the senior debt is paid back before the subordinated debt. Nevertheless, as the probability of default is the same for both senior and junior debt, the selection of the issuers is the primary key step to consider when investing in subordinated debt. Only once the risk of default of an issuer is fundamentally assessed, going down the capital structure of quality investment grade issuers (bearing a low probability of default) results in an interesting value opportunity to capture higher yields without increasing interest rate risk or credit risk.

Outlook for a young market

We view the subordinated debt market as being akin to where high yield was two decades ago. High yield is now well-understood and is a mainstream asset class which has evolved through the years. Likewise, the subordinated debt market will continue its evolution. Interestingly, the regulatory and financial advantages of subordinated bonds are now increasingly recognized by the market and the search for income is bringing the attention towards this asset class. We believe that going forward, the asset class should continue to gain wider acceptance and be in demand from yield-starved investors.

(The author of this article is Marcus Queree, Partner & Director of FundStream. Any information herein is only expressions and opinions. This document does not constitute an offer, an invitation to offer, or a recommendation to enter into any transaction, nor does it constitute investment advice. The information contained herein is confidential and reproduction of any part of this material is prohibited. If you are in any doubt as to the suitability of an investment you should always consult your financial adviser. FundStream does not receive any form of compensation for circulation of such material.)

FundStream provides independent investment solutions to professional advisors to suit their clients portfolio preferences. Our investor network of professional investors include: pension funds, family offices, fund of funds and wealth managers in Europe, Asia and South Africa.

ADDRESS

Kemp House

160 City Road

London EC1V 2NX

United Kingdom

CONTACTS

INFO LEGAL